If it seems too good to be true, it probably is! Scams are more sophisticated than ever, and staying informed is the key to protecting yourself. From phishing messages promising unimaginable rewards to phone calls pretending to be your bank, there’s a lot to look out for. At Home Federal Bank of Tennessee, we’re here to help, and want to empower you with the information you need to outsmart the latest tricks. Let’s delve into some of the most prevalent schemes currently circulating, their deceptive tactics, and how you can best avoid them.

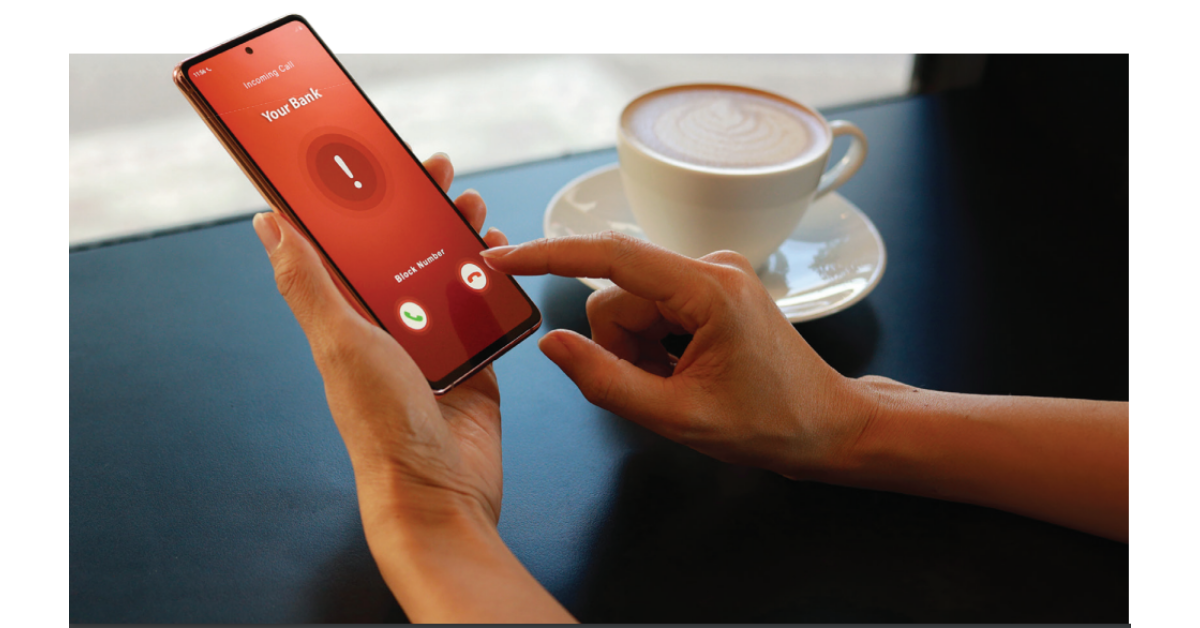

Caller ID Spoofing Scams

By manipulating the displayed phone number to appear as a trusted business or agency, scammers trick you into answering the call. Once connected, they might pretend to be a bank representative, government official, tech support agent, or other credible contact to extract sensitive information or initiate a fraudulent transaction.

Approach incoming calls with caution. Consider using call-blocking apps or services that can help filter out potential spoofed calls. Verify the legitimacy of the caller by contacting the official phone number of the supposed organization, and be careful about the information you give out or “verify” over the phone.

Fake Bank Communication Scams

The fake bank communication scam involves tracking online behavior and/or making an educated guess on where someone may bank based on their location or information extracted from social media. These scammers contact you, pretending to be from your bank. They even use official logos and professional language to draw you in, requesting upfront fees or expressing an urgent need to confirm your personal information. This can occur via email, text messaging, social media message, or phone call.

To stay safe, verify the legitimacy of an email communication by checking the validity of the sender’s address. The domain (i.e., the information after the @ symbol) should match your bank’s website address exactly. At Home Federal Bank of Tennessee, we will always use secure methods to contact you with any sensitive or urgent financial information. We’ll never contact you to ask for online banking login credentials, account reset codes, PIN, debit/credit card numbers, social security, or account information.

Check Overpayment Scams

This scam usually preys on individuals involved in online sales, job offers, or other transactions. A scammer sends a check to the victim that is often a large amount, exceeding the agreed-upon price. They then create an excuse for the overpayment, such as covering shipping or tax fees. The victim then deposits the check, wires the excess funds back, and later discovers the check was fraudulent. Banks may initially clear funds, as it takes a few days to recognize a fake check, allowing the scammers to vanish with the victim’s money.

Avoid this scam by exercising caution when dealing with transactions involving large checks. If a deal seems too good to be true or raises any suspicion, take the time to approach your bank with the check and verify its legitimacy. This way, you can confirm the status before initiating any transfers.

Check-Cashing Scams

Check-cashing scams take advantage of your generosity and typically take place when a stranger approaches you, often near a bank, seeking assistance in cashing a check. They might claim to not have an account at that specific bank. However, the check is later revealed to be fake. As previously mentioned, it takes time for the bank to discover this, during which time you may have already withdrawn money. Once the bank identifies the check as fraudulent, they will reverse the deposit, and the funds will be deducted from your own account.

Steer clear of check-cashing scams by politely declining any requests for assistance from a stranger. Avoid getting involved in financial transactions with strangers, especially if the situation seems suspicious or unlikely.

Scams Involving Job Opportunities

Amid remote work, scams involving job offers have found their way to the stage. Picture this: the promise of a legitimate remote job, accompanied by flexibility and substantial financial rewards. Seems like the ideal career move. However, things take an unexpected turn when you are subjected to an upfront payment requirement from your new “employer.” This is where you should become skeptical. Any new job requesting up-front payment for training, travel, accommodations, materials, or any other reason is likely a scam.

Do your research, read job offers thoroughly, and remain cautious. If you’re unsure about the legitimacy of a business, cross-check it through reputable agencies like the Better Business Bureau.

Asking a Favor & Gift Card Scams

An urgent request from someone you know–like a friend or coworker–asking you to pick up a few gift cards for them might seem innocent but be cautious. This is a very common scam where a scammer pretends to be someone you know asking for an urgent request. They look up your close contacts using online records and social media and might even create an email or account that looks like your friends or colleague. Scammers exploit our willingness to help by posing as friends in need, pushing for gift card purchases, and creating false scenarios about why they may need help. There is usually an element of urgency to these scams, as scammers hope you will act before thinking it through. They tell you to purchase the gift cards, then ask you to send images of the redemption numbers so they can cash in, take the money, and run. You’re left realizing that it wasn’t your friend or colleague on the other end of the request, and you’re out the money.

Before acting on such requests, pause and reach out to your friend directly through a separate call or text to confirm it’s them making the request and the situation is real.

Fake Amazon Employee Scams

As online shopping thrives, so do scammers. A new wave of related scams involves the impersonation of an employee at an online retailer (like Amazon). The scammer pretends to be a customer service representative through phone calls, aiming to gain personal data, account information, or money from the victim.

To shield yourself from these scams, be cautious about giving away personal information over the phone. Ignore unsolicited messages or calls regarding suspicious account activity, surprise gifts, giveaways, or unauthorized purchases. If you’re ever unsure, hang up and reach out to the retailer’s customer support line directly.

Catfishing & Online Dating Scams

Did you know that romance-related scams affect more than 70,000 people each year with a median financial loss of more than $4,000!? These scams target individuals looking for companionship or a romantic relationship. Scammers disguise themselves as potential partners, cultivate trust, establish emotional connection, and in the end, exploit the victim for financial gain.

Avoid becoming a victim by never sharing personal information with someone you’ve never met in person, regardless of the emotional connection formed online. This goes hand-in-hand with oversharing on social media, as scammers often use that information to manipulate the victim and push them to believe they are similar people. If you suspect you’ve experienced such a situation and have already sent money, take immediate action. Contact your bank, law enforcement, and the Internet Crime Complaint Center.

Fake Tech Support Scams

This scam occurs when individuals receive a message, phone call, or pop-up window that claims their computer is infected with malware or viruses, prompting you to act urgently and contact tech support. Scammers may also request full remote access to your computer or a payment to fix the issue. In this situation, the scammer often claims they are someone from a well-known or commonly utilized software company like Apple or Microsoft.

If you suspect your computer is compromised, install the latest security updates. If you receive a call from someone claiming to be from Apple or Microsoft, hang up and contact a genuine customer service number for the company to verify the legitimacy of the call. Remember, reputable software companies never initiate support calls on their own. If you made the mistake of granting someone access to your computer, change your login information as quickly as you can.

Payment App Scams

In a time of frequent digital transactions, payment app scams have become a growing concern, often targeting individuals via popular apps. This is likely since these payments are usually irreversible. They draw you in by impersonating authoritative figures, expressing urgent personal appeals like a sick family member, emotional manipulation, and many other tactics.

Limit your use of money-transfer apps to only friends, family and people you know and trust. Avoid using these apps to purchase items from strangers on the internet, where the risk of encountering scammers is much higher. You can also enhance your security by making your account private and turning on the passcode feature, requiring a passcode before making any payments.

Home Federal is glad to provide a convenient way to pay friends and family using Zelle, but highly caution against ever sending money to someone you do not know well and have never met in person.

Fake Government Agency Scams

Government agency scams, like many of the other tactics on our list, leverage fear. Oftentimes, an individual will receive an email or phone call from a fake government entity claiming they need to settle a debt immediately, pay money upfront to gain federal funds, or verify your identity. The victim is typically presented with a dire consequence for not acting quickly: You could lose your home, be subject to arrest, or become unable to receive Social Security benefits.

Always remember that the government will never contact you via email or phone, and it certainly will not ask you to pay back debt with a wire transfer or gift card. Be skeptical of these kinds of requests. Verify any claims through official channels, such as by contacting the relevant government agency independently using contact information from the official website. For your safety, never give out your home address or agree to meet someone in person.

Sweepstakes Scams

We’ve all received a message claiming something along the lines of “Congratulations! You just won a new iPad!” or “You’re the lucky winner! Redeem your cash prize here.” Welcome to the world of sweepstake scams. Typically, scammers will initiate contact through emails, text messages, or phone calls, notifying the victim of their luck. To claim the prize, victims will often be asked to provide personal information, pay upfront fees, or follow a series of steps. Unfortunately, there is never truly a prize, and any money or information shared will just become a loss. In this specific situation, it’s common for scammers to play a long game, slowly removing money from your account and opening new accounts in your name over time.

Legitimate sweepstakes do not require winners to pay upfront fees or provide sensitive information. Conduct independent research, check the sponsor’s website, or contact them directly using official contact information. Keep in mind that if you didn’t enter any contests or sweepstakes, you likely didn’t win one. Lastly, keep an eye on your bank account so you have a better chance of identifying the continuous fraud that may come from scams like this one.

Safeguard your Information & Avoid Scams Altogether

Taking proactive steps to shield your information and identity is more important than ever. Stay informed about the latest scams, recognize warning signs, and verify any suspicious communications independently. Utilize reputable security software, keep your systems updated, and exercise caution online, refraining from sharing sensitive details pertaining to your accounts, social security number, or location.

Lastly, and perhaps most importantly, maintain a healthy skepticism, scrutinizing offers that seem too good to be true, verifying legitimacy, and never giving out your personal information unless you’re absolutely positive a communication is legitimate.

At Home Federal Bank of Tennessee, we’re here to help. We employ a number of safety measures to keep your sensitive financial information safeguarded and protect our customers from fraud whenever possible. If you think you may have been the victim of a scam, don’t hesitate to contact us directly.